Some Ideas on 1031 Exchange Rules California You Need To Know

Table of ContentsNot known Details About What Is A 1031 Exchange California California 1031 Exchange for BeginnersThe 3-Minute Rule for 1031 Exchange1031 Exchange Fundamentals ExplainedSome Known Details About What Is 1031 Exchange California Getting My What Is A 1031 Exchange California To Work

Example: You quit utilizing your beach house, rent it out for six months or a year, and after that exchange it for another building. If you obtain a lessee as well as conduct on your own in a workaday way, after that you have actually most likely transformed the residence to a financial investment residential property, which ought to make your 1031 exchange all.

Relocating Into a 1031 Swap House If you wish to make use of the home for which you swapped as your new second or also key house, you can't relocate right now. In 2008, the internal revenue service collection forth a safe harbor rule, under which it stated it would not challenge whether a substitute dwelling certified as an investment residential or commercial property for objectives of Area 1031 (1031 exchange rules) - original site.

Your personal use of the dwelling system can not go beyond the greater of 14 days or 10% of the variety of days throughout the 12-month duration that the dwelling system is rented out at a fair rental. After successfully swapping one vacation or financial investment building for an additional, you can not instantly convert the new property to your key home and take benefit of the $500,000 exclusion.

Not known Facts About What Is 1031 Exchange California

Currently, if you get residential or commercial property in a 1031 exchange and later effort to offer that property as your principal home, the exemption will not apply throughout the five-year period starting with the day when the building was gotten in the 1031 like-kind exchange (Learn More). In other words, you'll need to wait a lot longer to use the primary house capital gains tax break.

Nevertheless, there is a means around this. Tax obligation obligations finish with fatality, so if you die without marketing the residential property obtained with a 1031 exchange, after that your beneficiaries won't be anticipated to pay the tax that you held off paying. They'll acquire the building at its stepped-up market-rate worth, also. These policies suggest that a 1031 exchange can be fantastic for estate preparation.

In the kind, you'll be asked to provide summaries of the properties exchanged, the days when they were identified and also moved, any kind of connection that you might have with the other celebrations with whom you exchanged residential or commercial properties, and the worth of the like-kind properties. You're additionally required to reveal the adjusted basis of the property given up and any obligations that you assumed or obtained rid of.

1031 Exchange Things To Know Before You Get This

If the IRS believes that you haven't played by the rules, then you can be struck with a huge tax obligation costs and also penalties. capital gains taxes california. Can You Do a 1031 Exchange on a Key Home? Typically, a key home does not qualify for 1031 therapy due to the fact that you live in that house as well as do not hold it for financial investment purposes.

1031 exchanges apply to actual home held for financial investment objectives. Just how Do I Adjustment Possession of Substitute Residential Or Commercial Property After a 1031 Exchange?

If you eliminate it promptly, the Irs (IRS) might assume that you really did not get it with the objective of holding it for financial investment purposesthe essential guideline for 1031 exchanges. What is an Instance of a 1031 Exchange? Kim owns an apartment that's presently worth $2 million, double what she paid for it seven years ago.

1031 Exchange Real Estate Can Be Fun For Everyone

5 million. By utilizing the 1031 exchange, Kim could, in theory, sell her apartment or condo building and also use the earnings to aid pay for the bigger substitute residential property without needing to stress regarding the tax liability straightaway. She is properly left with money to purchase the brand-new property by delaying resources gains and also devaluation regain taxes.

Generally, when that residential property is eventually sold, the internal revenue service will certainly want to regain a few of those reductions as well as factor them into the overall gross income. A 1031 can help to postpone that event click for more info by basically surrendering the expense basis from the old home to the new one that is changing it.

The Bottom Line A 1031 exchange can be made use of by smart investor as a tax-deferred technique to construct wealth. Nevertheless, the several intricate moving parts not just call for recognizing the policies however likewise employing expert aid also for experienced investors.

Little Known Facts About 1031 Exchange.

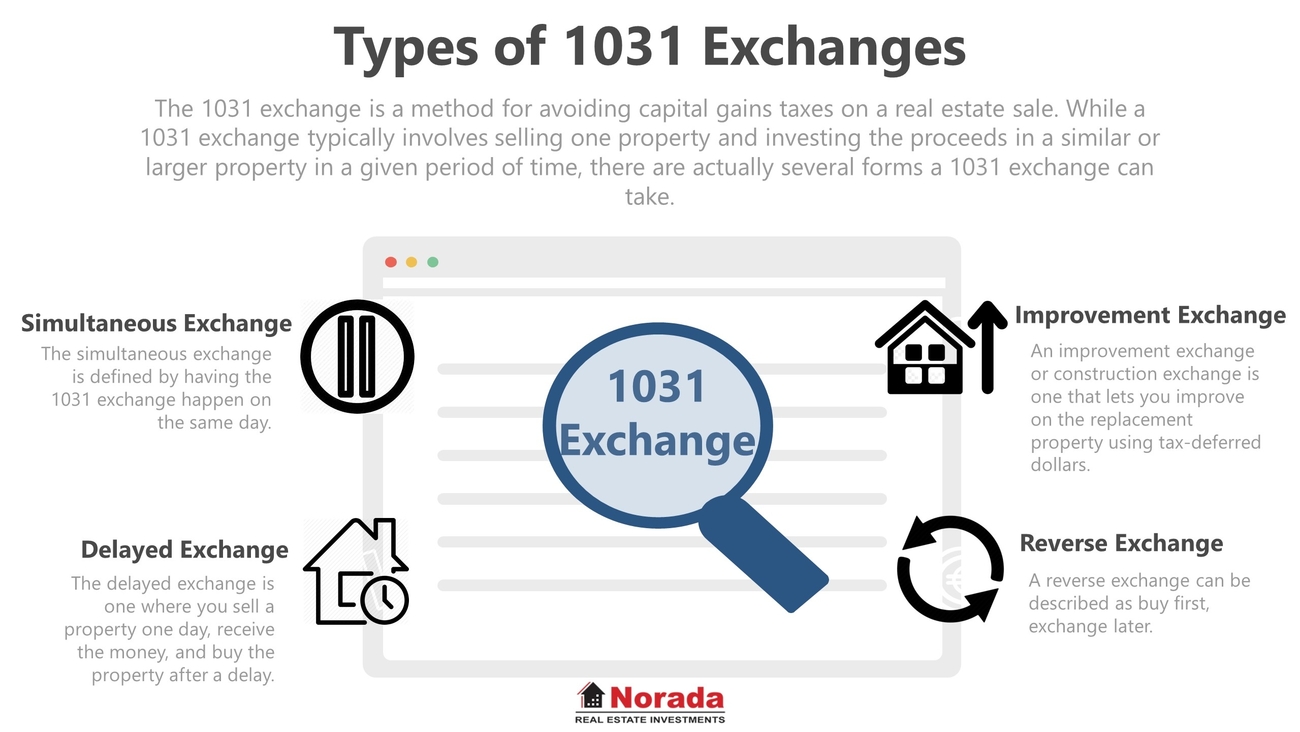

Wise genuine estate capitalists know that a 1031 Exchange is a typical tax strategy that aids them to expand their portfolios and increase total assets faster and extra efficiently than would otherwise be feasible. What is a 1031 Exchange, how does it work, what are the various kinds and just how do you stay clear of common errors? Full the 6 actions listed below and you'll find out every little thing you need to learn about 1031 Exchanges.

# 1: Understand Just How the IRS Defines a 1031 Exchange Under Section 1031 of the Internal Profits Code like-kind exchanges are "when you exchange real estate used for company or held as an investment exclusively for various other organization or investment home that is the very same type or 'like-kind'." This method has actually been allowed under the Internal Income Code since 1921, when Congress passed a law to prevent taxation of ongoing financial investments in building as well as additionally to motivate active reinvestment.

# 2: Identify Qualified Properties for a 1031 Exchange According to the Internal Revenue Solution, residential property is like-kind if it coincides nature or character as the one being changed, also if the top quality is various. The IRS takes into consideration actual estate building to be like-kind despite how the realty is boosted.

Some Ideas on 1031 Exchange Fund You Should Know

That includes items such as machinery, equipment, artwork, collectibles, licenses and intellectual building (More Help).